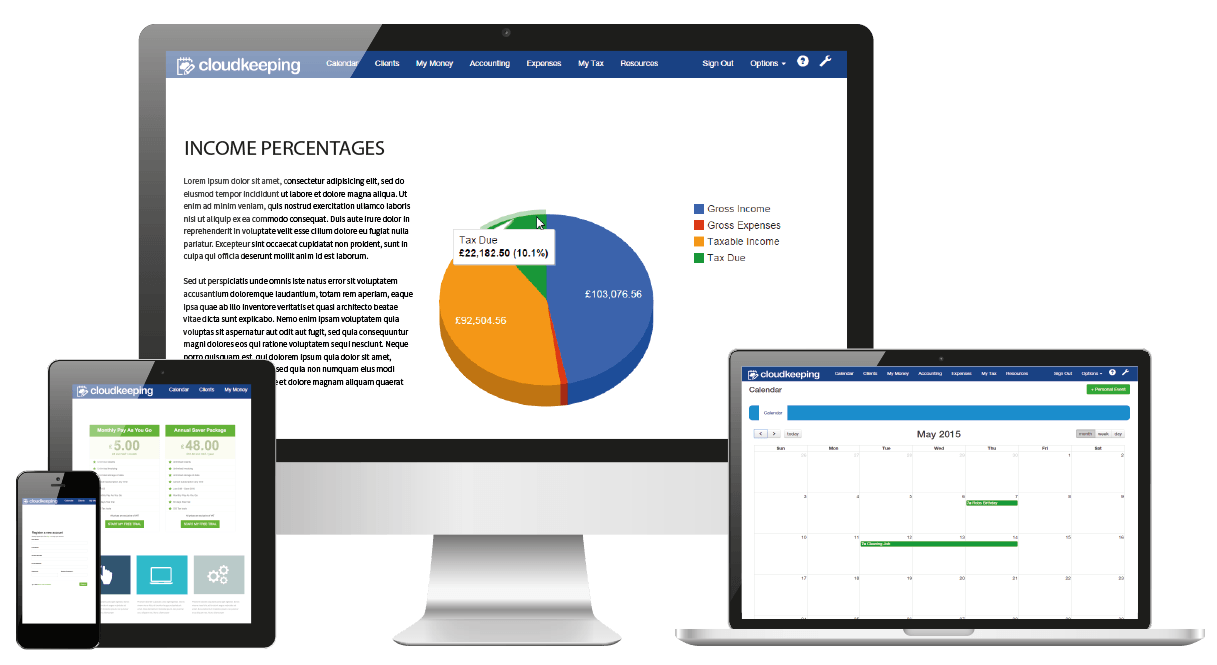

Easy to use online bookkeeping and accounting software

cloudkeeping's provides simple and effieicent accountancy software for soletrader and small business owners to manage and streamline their businesses accounts.

cloudkeeping's provides simple and effieicent accountancy software for soletrader and small business owners to manage and streamline their businesses accounts.

Pete S. entrepreneur

Know exactly how much you owe HMRC in real time enabling you to budget.

Create branded invoices / receipts from a simple template.

Convenient access to your customer database when raising invoices / receipts and tracking payments.

Download your transactions into a CSV file, hand it to your accountant and keep your tax return costs low.

Add your expenses and our software automatically incorporates these into your tax liability calculation.

Have various sources of income? Our smart tax calculator allows you to incorporate and track all of these income streams, providing you with an accurate year end tax liability.

Add your invoice & payment dates, appointments, tasks and reminders to your calendar for easy reference.

Allocate CIS tax deductions against invoice payments and have these deductions automatically incorporated into your net tax liability.

Software is fully VAT Compliant, calculating your quarterly VAT liability for both regular and flat rate and VAT schemes.

The ability to add your existing data from 2008/2009 tax year.

If you use a vehicle (car, motorcycle or bicycle) for the purposes of trade then you can reduce your tax liability. Track and claim all your mileage usage in one easy to use tool.

If you use your Home as an Office for the purpose of trade, HMRC will allow you to claim part of your running costs as an expense. Home As Office usage can be tracked, adjusted and incorporated into your tax liability and will be calculated as a single expense.

cloudkeeping for Sole Traders & Multi Level Marketers is an online income and tax management tool to help self-employed individuals manage their money effectively through an easy to use online bookkeeping portal.

cloudkeeping has been designed to be as straightforward as possible so that you can submit your own self-assessment tax return without having to employ an accountant or if you want to use our self-assessment tax return service and get your return checked by a professional accountant, we can help you with that. Our software enables self employed individuals to manage their finances such as invoicing, expenses, PAYE income, investments, dividends, interest and all cash transactions.

cloudkeeping’s unique tax calculator tool uses the data you input to automatically calculate and track your VAT, PAYE, EENI and other tax liability figures. This means that you know exactly what taxes you owe HMRC at any given time and can budget for them.

Dylan T

Self Employed ContractorI have used cloudkeeping for just over a year now. I wish I had found out about it earlier. My financial affairs are all in order now and there is no confusion regarding how much tax I need to pay. A great tool and I look forward to whatever upgrades are added in the future!

Ally M

I am a self employed freelancer within the UK events industry and my job means I’m on the road a lot. To generate cash flow means I need to invoice my clients efficiently. To do this, I build the invoices from my mobile phone and send them to my clients from the palm of my hand whilst I am on the go. The expense management system is also useful as I generate a lot of receipts when away on tours. All in all, cloudkeeping has made keeping on top of my accounts a breeze.

Anita P

Until I started using cloudkeeping, I never knew how much I owed the “Tax Man” until I got a nasty bill. Now, I input all my invoices, expenses, incomes, outgoings in the very clever, yet simple cloudkeeping system from my phone, ipad or laptop and at a click of a button. I know exactly how much I need to budget for tax and I am confident that my finances are in perfect order.

Rob W

cloudkeeping helped me prove my earnings when I was applying for a tenancy agreement. My new landlord needed proof of my earnings so I conveniently logged into my cloudkeeping account on my iPad, whilst with him, and showed him exactly what I had invoiced to date. This gave him confidence to immediately agree the contract.

After undertaking a lot of competitor research I transitioned to cloudkeeping from another online bookkeeping company. I chose cloudkeeping as I found the system intuitive and simple to use, which allows me to focus on running my business.

2024 © cloudkeeping. All Rights Reserved. Privacy Policy | Terms of Service | Contact Us